Food safety and quality is the most important issue in the global food supply chain. Though India is self-sufficient in the production of most of the agricultural produces our contribution is negligible in the world market. The quality and safety of the fresh, as well as processed, have an important role in the spices export. Increasingly stringent food safety and agricultural health standards in industrialized countries pose major challenges for continued developing country success in international markets for high-value food products, such as fruit, vegetables, fish, meat, nuts, and spices.

- KEY FACTS & FIGURES

- India is the world’s largest producer, consumer, and exporter of spices.

- In FY 2023-24, India exported spices & spice products worth US$ 4.46 billion, up from ~US$ 3.73 billion in FY 2022-23.

- Volume in FY 2023-24 was about 1.54 million tonnes (≈ 15,39,692 tonnes) of spices & spice products.

- By FY 2024-25, exports rose in both value and volume: ~1.80 million metric tonnes, valued at approx US$ 4.72 billion.

Strategies to Enhance India’s Spice Export

Yet, in many cases, such standards have played a positive role, providing the catalyst and incentives for the modernization of export supply and regulatory systems and the adoption of safer and more sustainable production and processing practices. This has created an increased need for updated research and development to demonstrate and provide adequate evidence for their ability to identify and control food safety hazards and deal specifically with food quality and safety.

How big is the spices industry in India?

India is the world’s largest producer and consumer of spices and one of its leading spice exporters. The spice export and spice products reached an all-time high in FY 2023-24 and attained 4.46 billion USD. According to the Spices Board India, during 2023-24 the export of spices/spice products from the country has been 15,39,692 tons valued Rs.36958.80 crore (4464.17 million US$).

- As per Indian spices export data, the export of spices from Inidia has been 15,39,692 tons valued at USD 4464.17 million during 2023–24.

- As per spice export data, red chilli is the most exported spice from India, with a value of INR 3,408 crore.

- As per spice export data, spice export from India have 282k shipments, exported by 6,674 Indian exporters to 15,293 buyers.

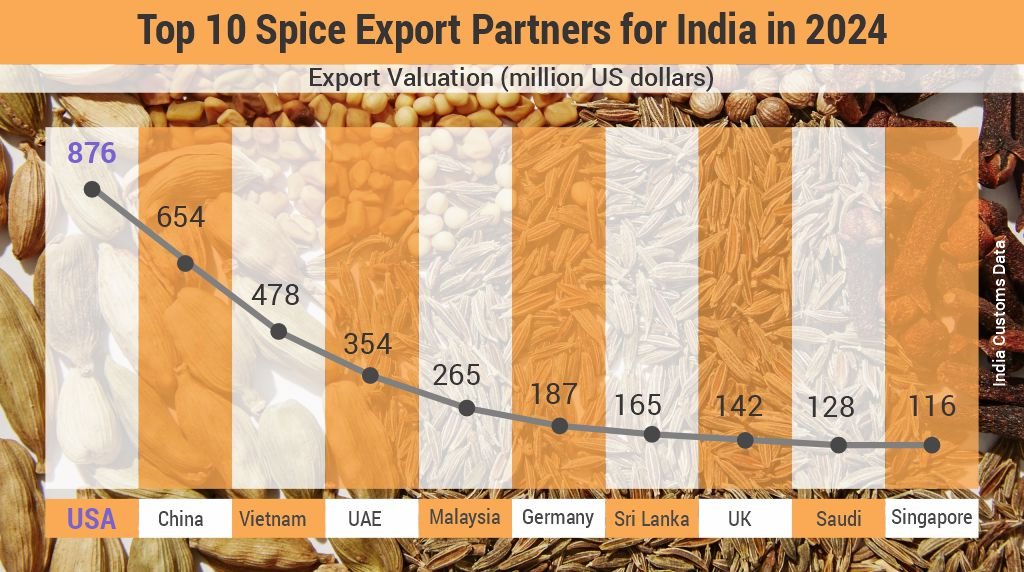

- The top importing countries of spices from India are the United States, Germany, the Netherlands, the United Arab Emirates, and Japan.

Major products for spice export

The major spices are black pepper (Piper nigrum), cardamom (Elettaria cardamomum), Cinnamomum (Cinnamomum camphora), chilly pepper (Capsicum annuum), clove (Syzygium aromaticum), coriander (Coriandrum sativum), cumin (Cuminum cyminum), garlic (Allium sativum), ginger (Zingiber officinale), turmeric (Curcuma longa), vanilla (Vanilla planifolium), nutmeg and mace (Myristica fragrans).

However, the top 10 Spices export from India is red chilli, cumin, coriander, turmeric, fennel, fenugreek, cardamom, mustard, ginger, and black pepper. These spices are utilized in a variety of cuisines around the world, as well as in the food, cosmetic, and pharmaceutical industries.

Value addition to Spices

In the last few years, India has shown a tremendous increase in spice value addition too. With the recent contraction of the bulk pepper trade, and with the expansion in trade in various spice oils, oleoresins, and powders, India’s trade in value-added spice products is now approaching its level of trade in bulk spices and will almost certainly surpass that in the coming years. India, however, has encountered a number of food safety problems in its spice export including high pesticide residues, aflatoxin contamination and the use of prohibited food colorants.

Enhancing India’s Spice Trade Competitiveness

India’s spice trade has long been renowned for its product quality and marketing acumen. However, intensified global competition and evolving regulatory and buyer requirements in key markets have challenged Indian producers, processors, and exporters. Regulatory agencies like the Spices Board and other governmental bodies are working to address these challenges. Exporters face increased scrutiny for issues like microbiological or chemical contamination, prompting the need for robust responses.

Recent developments in global trade have further emphasized the importance of compliance with food safety standards. For example, the EU and the US have implemented stricter Maximum Residue Limits (MRLs) and introduced mandatory traceability systems under regulations like the EU’s Green Deal and Farm-to-Fork Strategy. These changes impact the Indian spice sector, which must now adhere to sustainable and residue-free practices to retain its market share.

Improved Agricultural and Post-Harvest Practices

To stay competitive, India must leverage its technological advancements and promote Good Agricultural Practices (GAP) and better post-harvest methods among spice growers. Strengthened enforcement of pesticide regulations and food safety standards is critical. Recent initiatives, such as blockchain-based traceability systems piloted by the Spices Board, are aimed at ensuring transparency and quality throughout the supply chain.

Addressing Historical and Emerging Challenges

Past challenges, such as the rejection of Indian dry chilies due to pesticide residues and aflatoxins in the 1990s, and the high-profile Sudan 1 dye contamination in 2005, highlighted the need for stricter controls. While significant progress has been made, contemporary challenges, such as ensuring compliance with non-tariff barriers and residue-free certification, remain pressing concerns.

Strengthening Post-Harvest Processing

The current state of post-harvest processing of spices is suboptimal, leading to product spoilage and export rejections. Poor storage practices, unscientific use of fertilizers, and unhygienic processing methods exacerbate the problem. Investments in modernizing processing facilities and training farmers in scientific practices are essential. For instance, the adoption of solar drying techniques and fumigation protocols is helping to mitigate fungal contamination.

Enhancing Quality Standards

The quality of spices is determined by intrinsic attributes, such as chemical properties (volatile oils, alkaloids, and oleoresins), and extrinsic factors, like appearance, texture, and absence of contaminants. Compliance with health standards—such as limits on pesticide residues, aflatoxins, heavy metals, and microbiological contaminants—is increasingly vital for export. To ensure consistency, the adoption of Good Manufacturing Practices (GMP), GAP, and Hazard Analysis and Critical Control Points (HACCP) is critical.

Strategies to Meet Challenges

India’s spice industry must focus on:

- Strengthening the Regulatory Framework: Upgrading testing facilities to meet international standards, enhancing personnel capabilities in risk analysis, and improving HACCP auditing and implementation.

- Utilizing Technological Advances: Leveraging blockchain, AI, and IoT for traceability and quality control.

- Developing Export-Focused Programs: Implementing GMP/GHP/HACCP modules for both domestic and export-oriented production.

- Building Databases: Establishing comprehensive, accessible databases on importing-country requirements.

India is actively funding these initiatives and seeking support from organizations like the FAO and UNIDO. With a strong track record and ongoing efforts to modernize, India is well-positioned to meet emerging challenges and maintain its leadership in the global spice market.

Conclusion

For a long period, India has been among the world leaders in the production, trade, and application of post-harvest and processing technologies to spices. India also has, by far, the largest domestic market for spices in the world. India’s spices are sold throughout the world. Thus, it is an industry with an exceptionally broad and historical perspective. To continue to be, or to become, competitive in both of these areas, India must make effective use of the installed technological and testing capacities put in place over the past decade or two. Furthermore, there will need to be an intensification of efforts to promote “Good Agricultural Practices” among spice growers.

The lack of harmonization of international standards for spices is a cause for some uncertainty within the trade and added costs for spice exporters since they must use different technologies and employ different types of tests to satisfy different markets. The harmonization of international standards would reduce this uncertainty and enable more uniform procedures. Adoption of new and hygienic production and post-production methods coupled with infrastructure development for testing methods and sampling procedures will enhance the return of spice growers, processors, and exporters through the increased domestic and international market.

The challenges of ensuring food safety in the domestic market and in its food exports remain large. India has made some progress in the last decade to strengthen food safety measures at home and in meeting food safety and SPS standards abroad. The challenge for the future will be to adopt a more strategic, rather than crisis management approach. This will be essential to ensuring the sustainability and cost-effectiveness of these efforts.

FAQs on Food Safety, Spice Exports, and Industry Challenges

Why is food safety important in the spice export industry?

Food safety is critical because stringent global standards on pesticide residues, aflatoxins, and other contaminants directly affect the acceptance of spices in international markets. Non-compliance can lead to rejections and financial losses.

How significant is India’s contribution to the global spice market?

India is the world’s largest producer and consumer of spices, with spice exports reaching a record $4.46 billion in FY 2023-24. The country exported 15,39,692 tons of spices to over 15,000 buyers worldwide.

What are the top spices exported from India?

The leading exported spices include red chili, cumin, coriander, turmeric, fennel, fenugreek, cardamom, mustard, ginger, and black pepper. These are used in global cuisines and industries like food, cosmetics, and pharmaceuticals.

What challenges does India face in the spice export market?

India faces challenges such as high pesticide residues, aflatoxin contamination, use of prohibited food colorants, and evolving global regulatory standards, including stringent Maximum Residue Limits (MRLs) and traceability requirements.

What measures are being taken to improve spice quality and safety?

India is promoting Good Agricultural Practices (GAP) and modern post-harvest methods, implementing blockchain-based traceability systems, and upgrading testing facilities to comply with international standards.

What is the role of value addition in spice exports?

Value addition through products like spice oils, oleoresins, and powders has grown significantly. India’s trade in value-added spice products is approaching and expected to surpass bulk spice trade in the coming years.

How does India address post-harvest challenges in spices?

India is modernizing post-harvest processing by adopting scientific practices like solar drying and fumigation to reduce spoilage and contamination. Training programs for farmers and processors are also being implemented.

How can India sustain its competitiveness in the global spice market?

India can maintain its edge by strengthening its regulatory framework, leveraging technology like AI and IoT for quality control, developing export-focused programs, and building comprehensive databases on importing-country requirements.

What are the major importing countries of Indian spices?

The United States, Germany, the Netherlands, the UAE, and Japan are the top importers of Indian spices.

What organizations support the spice industry in India?

The Spices Board of India, FSSAI, along with international bodies like FAO and UNIDO, plays a vital role in funding, research, and regulatory support to enhance the quality and global reach of Indian spices.

References

- Alerts. 2004. Rapid alert system for food and feed. European Commission, http://europa.eu.int/comm/food/food/rapidalert/index_en.htm.

- Codex Alimentarius: http://www.codexalimentarius.net/mrls/pestdes/pest_ref /MRLsSpicese.pdf

- Aydin. A, E.M. Erkan, R. Baskaya and G. Ciftcioglu, 2007. Determination of aflatoxin B1 levels in powdered red pepper, Food Control. 18, pp. 1015–1019.

- European Union .2003. Emergency Measures Regarding Hot Chilly and Hot Chilly Products. Commission Decision 2003/460/EC.

- European Union .2004. Emergency Measures Regarding Chilly and Chilly Products. Commission Decision 2004/92/EC.

- http://www.astaspice.org/pubs/sudanwhitepaper.pdf.

- Spice board of India, 2009. Ministry of Commerce and Industry, Gov. of India, (http://www.indianspices.com/)

- Pritty, S. B, K. P. Sudheer, M. C. Sarathjith, and A. A. Tina. 2012. Development of GMP and HACCP Protocol for Pepper Industry, Int. J. Agril. Fd. Sci .Technol, 3(1): 22-39.

- Srivastava LP, Budhwar R, Raizada R.B. 2001. Organochlorine pesticide in Indian spices. Bull Enviorn Contam Toxicol. 67:856–862.

- WHO (http://www.who.int/mediacentre/factsheets/fs125/en/)