Explore the Indian ice cream industry, its history, top brands, production, sustainability, emerging trends, herbal innovation, and future growth opportunities.

India’s ice cream industry has evolved from a modest, season-driven segment into a high-growth, innovation-led fast-moving consumer goods (FMCG) category. Once limited to summer consumption and urban markets, the sector now reflects strong year-round demand, expanding geographic penetration, and increasing product sophistication. Structural drivers such as rising disposable incomes, rapid urbanisation, expansion of organised retail, digital commerce, and improved cold chain infrastructure have collectively transformed the competitive landscape.

This article presents a comprehensive analysis of the Indian ice cream ecosystem, its historical development, production framework, leading brands, sustainability initiatives, emerging innovation trends, and long-term growth opportunities.

Historical Evolution of Ice Cream Brands in India

The trajectory of the Indian ice cream market mirrors the country’s broader economic transformation. Frozen desserts were introduced during the colonial era, primarily consumed by elite urban populations. However, commercialisation at scale began post-independence, supported by the growth of India’s dairy sector and cooperative movements.

The establishment of dairy cooperatives such as Amul laid the foundation for organised milk procurement and processing. This enabled a reliable raw material supply for large-scale ice cream production. The liberalisation of the Indian economy in 1991 further catalysed market expansion by opening the doors to multinational players and private sector investment.

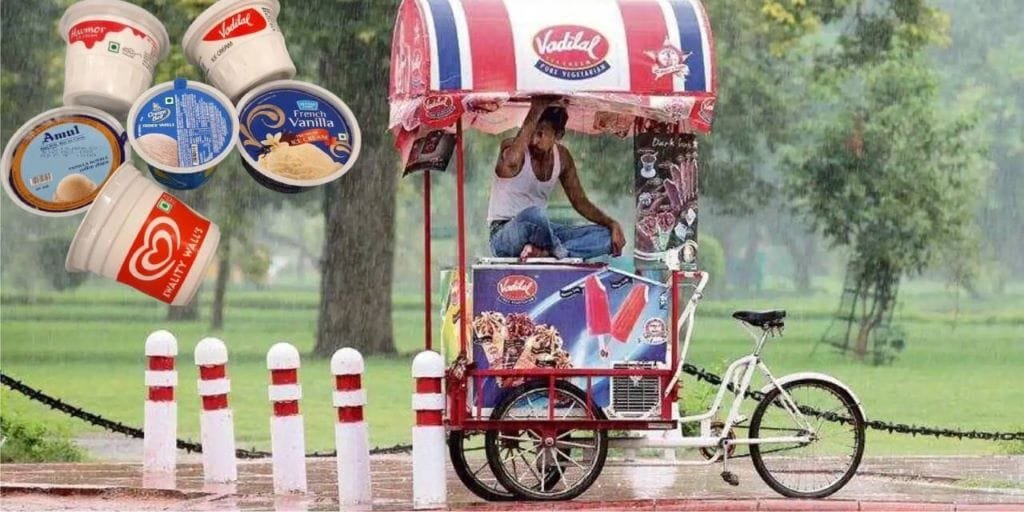

Global brands such as Hindustan Unilever strengthened the premium and impulse segments through its ice cream brand Kwality Wall‘s. In contrast, regional specialists such as Vadilal Industries and Mother Dairy expanded distribution across northern and western India.

Indian brands differentiated themselves by adapting global formats to local preferences. Indigenous flavours, kesar pista, mango, tender coconut, anjeer, and paan, enabled strong cultural resonance. Over time, these companies transitioned from regional footprints to national presence, supported by vertical integration and distribution optimisation.

A detailed chronicle of this evolution can be explored in A Brief History of Ice Cream Brands in India.

Understanding this historical progression is critical to contextualising the industry’s current maturity and competitive intensity.

Production, Processing and Consumption Dynamics

Modern ice cream manufacturing in India adheres to a structured, technologically controlled process. The production cycle typically involves:

- Milk standardisation to achieve desired fat and solids-not-fat (SNF) ratios

- Pasteurisation to eliminate pathogenic microorganisms

- Homogenisation to improve fat dispersion and texture

- Ageing to stabilise the mix

- Flavour incorporation and freezing

- Hardening and packaging under controlled cold chain conditions

Regulatory oversight by the Food Safety and Standards Authority of India (FSSAI) ensures compliance with quality standards, labelling accuracy, and hygiene standards.

Cold chain integrity is particularly critical. Ice cream requires storage at –18°C or lower to preserve texture and prevent microbial growth. Investments in refrigerated transport, insulated cabinets, and rural cold storage infrastructure have enabled deeper market penetration.

Consumption patterns in India remain skewed toward summer months, yet this seasonality is gradually moderating. Premium formats, in-home tubs, and festive offerings are driving winter and year-round demand. Tier-2 and Tier-3 cities are emerging as significant growth centres due to rising aspirations and improved retail access.

A technical deep dive into manufacturing and market data is available in Production, Processing and Consumption of Ice Cream in India.

Market Structure and Leading Brands

India’s ice cream industry is characterised by a hybrid competitive structure comprising multinational corporations, dairy cooperatives, and strong regional players.

Key market leaders include:

- Amul

- Kwality Wall’s

- Vadilal Industries

- Mother Dairy

- Havmor Ice Cream

Each competes across multiple price tiers, mass impulse sticks, family packs, premium tubs, and novelty formats.

Competitive differentiation is increasingly driven by:

- Extensive cold chain distribution networks

- Brand recall and marketing investments

- New product development cycles

- Strategic retail placement

- Digital engagement and quick-commerce partnerships

Premiumisation is intensifying competition. Experiential parlours, gourmet flavours, and limited-edition launches are targeting urban millennials and Gen Z consumers seeking novelty.

A detailed brand evaluation can be found in Top 10 Ice Cream Brands in India.

Sustainability as a Strategic Imperative

Ice cream manufacturing is energy-intensive, relying heavily on refrigeration, water usage, and dairy sourcing. Environmental sustainability has therefore become a core operational and reputational priority.

Leading players are implementing initiatives such as:

- Transitioning to renewable energy sources in production facilities

- Sustainable dairy procurement and traceability programs

- Biodegradable or recyclable packaging materials

- Water stewardship and waste reduction measures

- Carbon footprint assessment and reduction strategies

Younger consumers are increasingly environmentally conscious, influencing purchase decisions. Sustainability metrics are no longer peripheral, they directly impact brand equity and investor confidence.

An in-depth review of these initiatives is covered in Sustainability Efforts by Ice Cream Brands.

Emerging Trends Reshaping the Industry

The Indian ice cream sector is undergoing rapid transformation, driven by changing lifestyles, increased health awareness, and the expansion of digital commerce.

Health & Wellness Variants: Low-sugar, keto-friendly, high-protein, lactose-free, and plant-based formulations are gaining momentum. Consumers are demanding permissible indulgence, products that balance taste with nutritional positioning.

Artisanal and Gourmet Offerings: Small-batch producers and premium chains are offering exotic flavours such as salted caramel, Belgian chocolate, matcha, and tiramisu. In-store experiential formats are enhancing brand storytelling.

Regional and Functional Ingredients: There is growing interest in incorporating Ayurvedic herbs, millets, and indigenous botanicals into formulations. This fusion of tradition and technology provides localisation advantages.

Digital & Direct-to-Consumer Channels: E-commerce platforms and quick-commerce apps have redefined distribution. Ice cream brands are leveraging data analytics, subscription models, and geo-targeted promotions to optimise demand forecasting.

A structured trend analysis is available in Latest Emerging Trends in Ice Cream Industry.

Herbal Ice Cream Innovation: Functional Convergence

One particularly promising niche is herbal or functional ice cream. The integration of medicinal botanicals into dairy matrices represents a convergence of nutraceutical and indulgence categories.

Research into formulations such as Preparation of Herbal Ice Cream Using Phyllanthus niruri demonstrates how traditional medicinal plants can be incorporated into frozen desserts without compromising sensory properties.

Phyllanthus niruri, known for its antioxidant and hepatoprotective attributes in traditional medicine, offers:

- Phytochemical enrichment

- Functional positioning

- Novel flavour differentiation

- Premium pricing potential

Such innovations reflect a broader shift toward value-added, health-forward frozen products that cater to evolving consumer expectations.

Growth Opportunities and Strategic Outlook

India’s per capita ice cream consumption remains significantly lower than that of developed markets, indicating substantial untapped potential. The long-term opportunity landscape includes:

Geographic Expansion: Rural and semi-urban markets present scalable demand once cold chain gaps are addressed.

Premium & Functional Segments: Health-oriented, plant-based, and herbal formulations offer margin expansion opportunities.

Export Potential: Neighbouring South Asian, Middle Eastern, and African markets represent viable export destinations.

Institutional & HoReCa Channels: Hotels, restaurants, cafés, and catering services are expanding bulk procurement.

Cold Chain Investments: Technological upgrades in refrigeration and logistics will reduce wastage and enhance penetration.

Private Label & Contract Manufacturing: Modern retail chains increasingly seek private-label frozen dessert partnerships.

A comprehensive industry outlook is provided in Opportunities for Ice Cream Industry in India.

Conclusion

The Indian ice cream industry stands at a structurally advantageous inflection point. What began as a seasonal indulgence has evolved into a diversified, innovation-intensive FMCG segment with strong growth fundamentals.

Historical institutional support from dairy cooperatives, technological advances in production, expansion of cold chain infrastructure, rising health awareness, digital commerce penetration, and sustainability-driven brand strategies collectively define its trajectory.

For manufacturers, investors, entrepreneurs, and researchers, success will depend on aligning operational efficiency with consumer-centric innovation and environmental responsibility. Companies that integrate advanced production systems, functional differentiation, and sustainable supply chains will likely dominate the next phase of growth. India’s ice cream market is no longer merely about frozen desserts, it is a case study in how traditional food categories can be re-engineered for modern consumer ecosystems.

💡 Indian Ice Cream Industry: Some FAQs

The Indian ice cream industry is experiencing strong double-digit growth driven by rising disposable incomes, urbanisation, premiumisation, and improved cold chain infrastructure. Low per capita consumption indicates substantial future potential.

Major brands include Amul, Kwality Wall’s, Vadilal Industries, Mother Dairy, and Havmor Ice Cream, competing across mass and premium segments.

The process includes milk standardisation, pasteurisation, homogenisation, ageing, flavour incorporation, freezing, hardening, and packaging under strict cold chain control.

Companies are adopting renewable energy, sustainable sourcing, recyclable packaging, and carbon reduction strategies to meet regulatory and consumer expectations.

Low-sugar variants, plant-based options, artisanal flavours, functional ingredients, and digital sales channels are reshaping the market.

It incorporates medicinal or nutritionally beneficial ingredients into traditional formulations, targeting health-conscious consumers.

Ice cream must be stored at -18°C or below to maintain safety and quality. Cold chain efficiency ensures product integrity across distribution.

Premiumisation, plant-based innovation, rural expansion, private label manufacturing, and export markets offer strong growth avenues.

While summer remains peak season, premium formats and online delivery are gradually reducing seasonal dependence.

Yes. Compared to developed markets, India’s per capita consumption is low, indicating high future growth potential.

Have a news or topic to share with industry? Write to us editorial@pfionline.com